Streamline Loans, Empower Borrowers, Maximize Profitability.

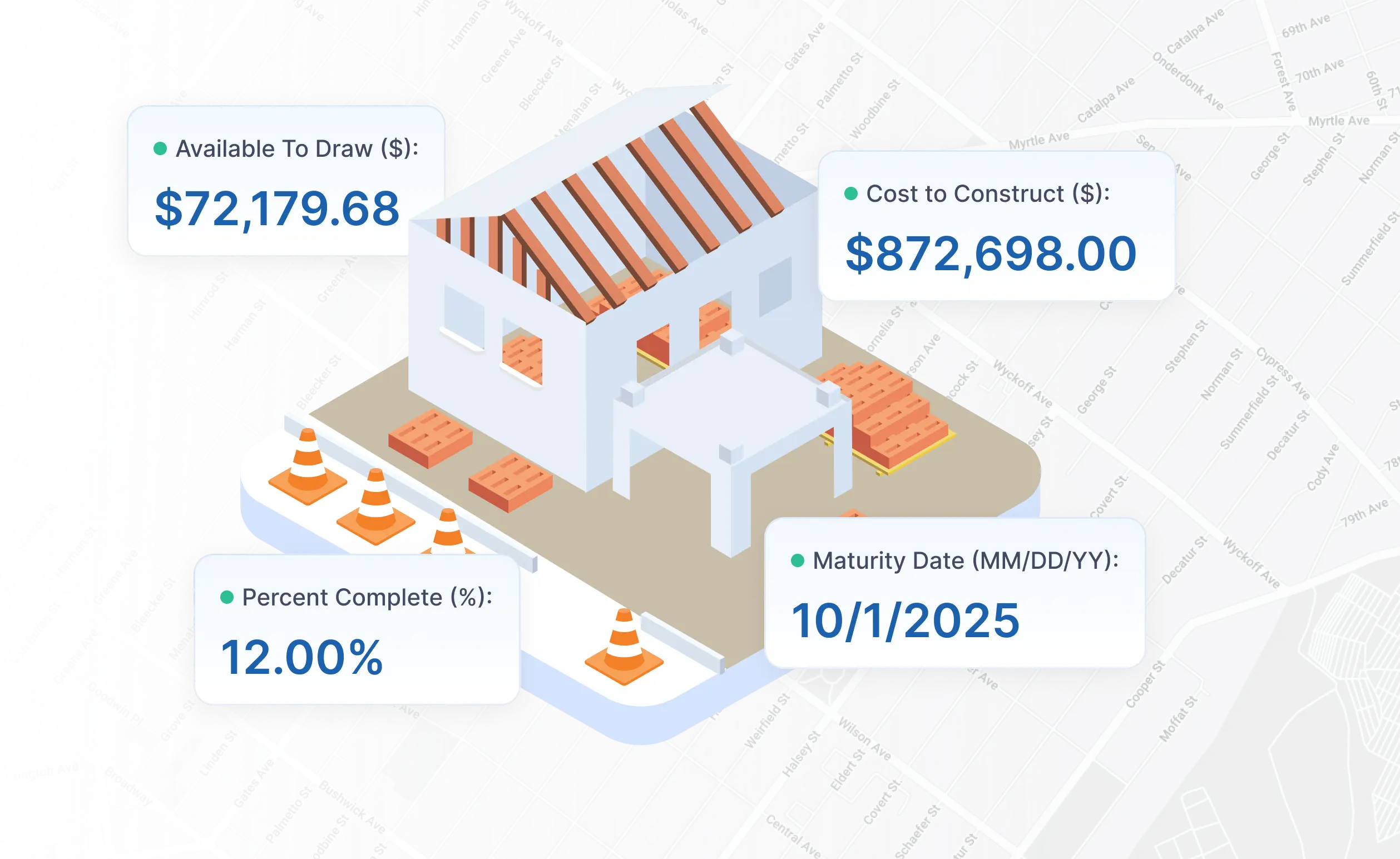

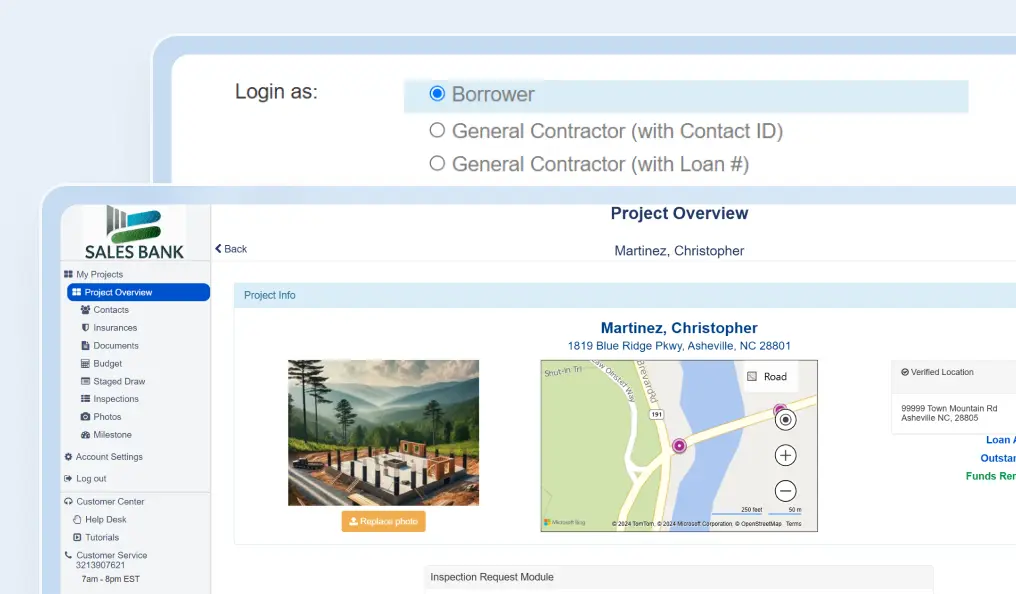

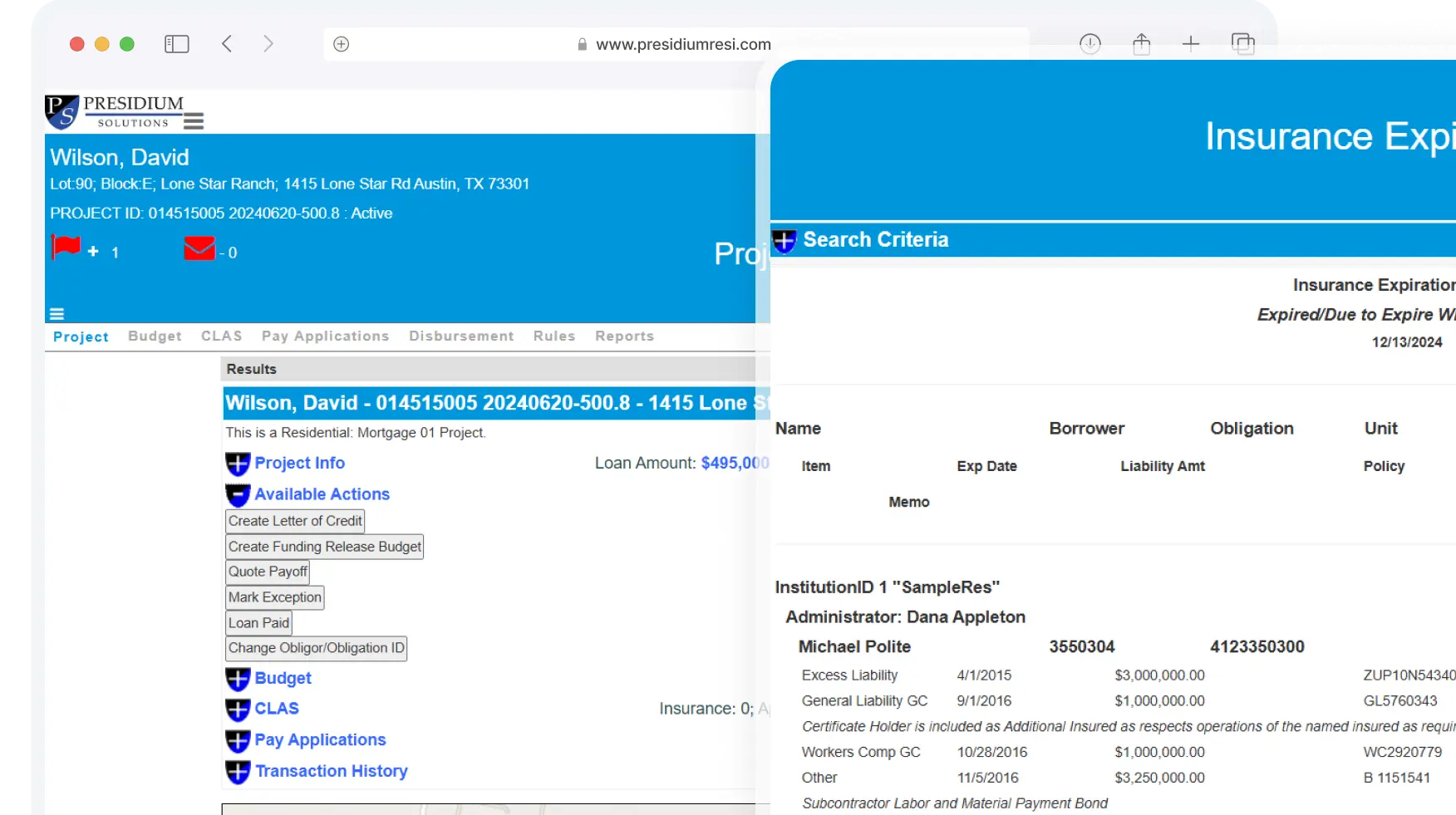

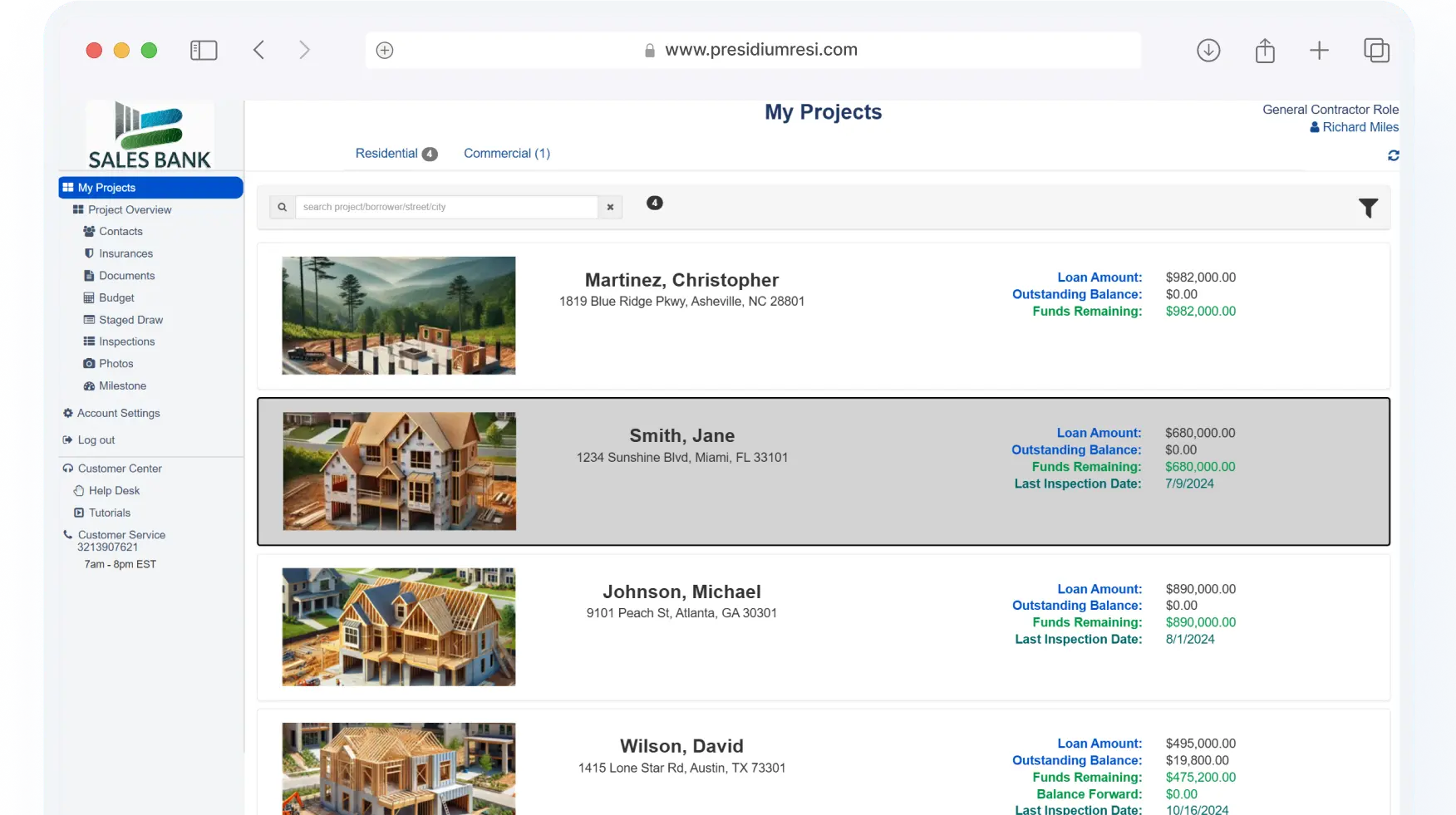

Deliver real-time insights to lending teams, borrowers, and inspectors, fostering trust and clarity.

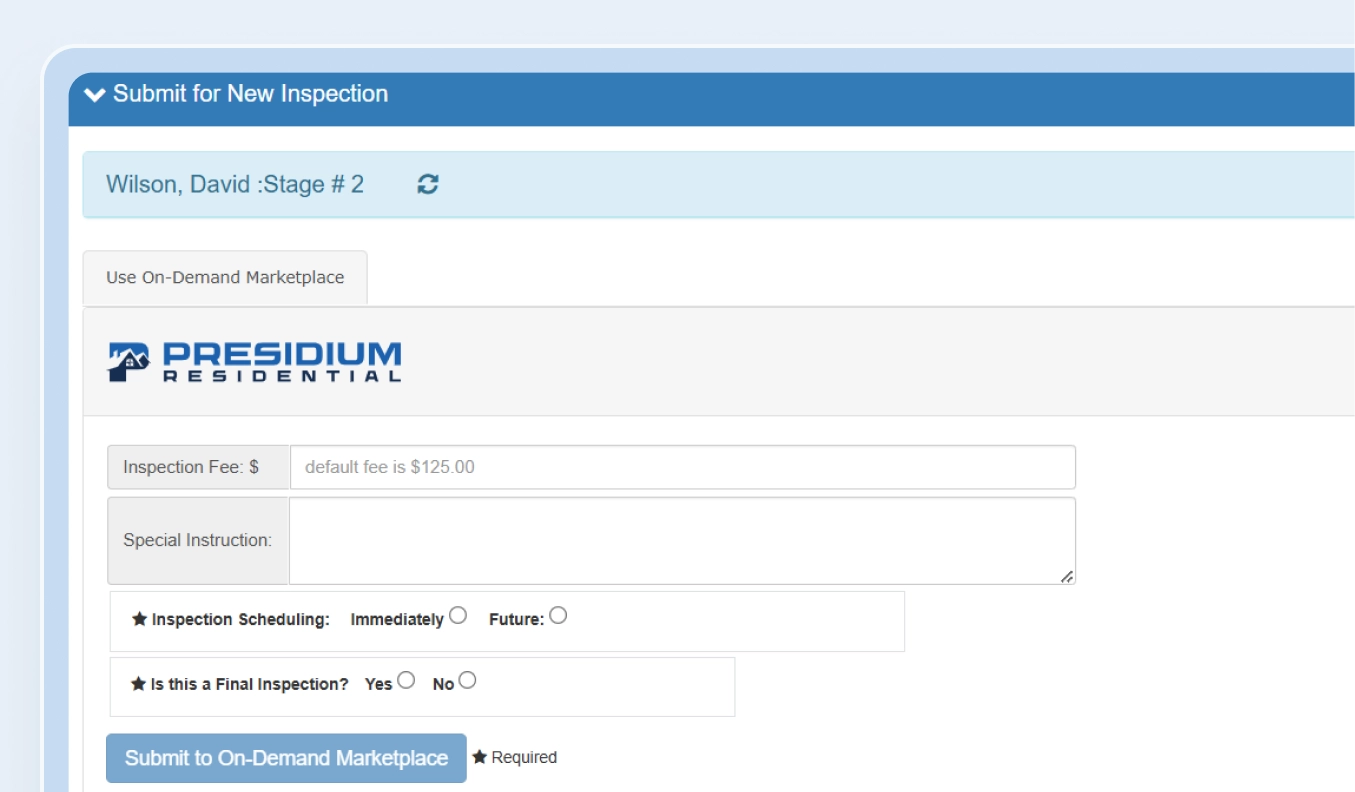

Streamline workflows to minimize delays and errors, ensuring a smooth lending process.

Adapt to various portfolio sizes and project types, providing flexibility as your business grows.

Built for Transparency, Risk Mitigation, and Growth

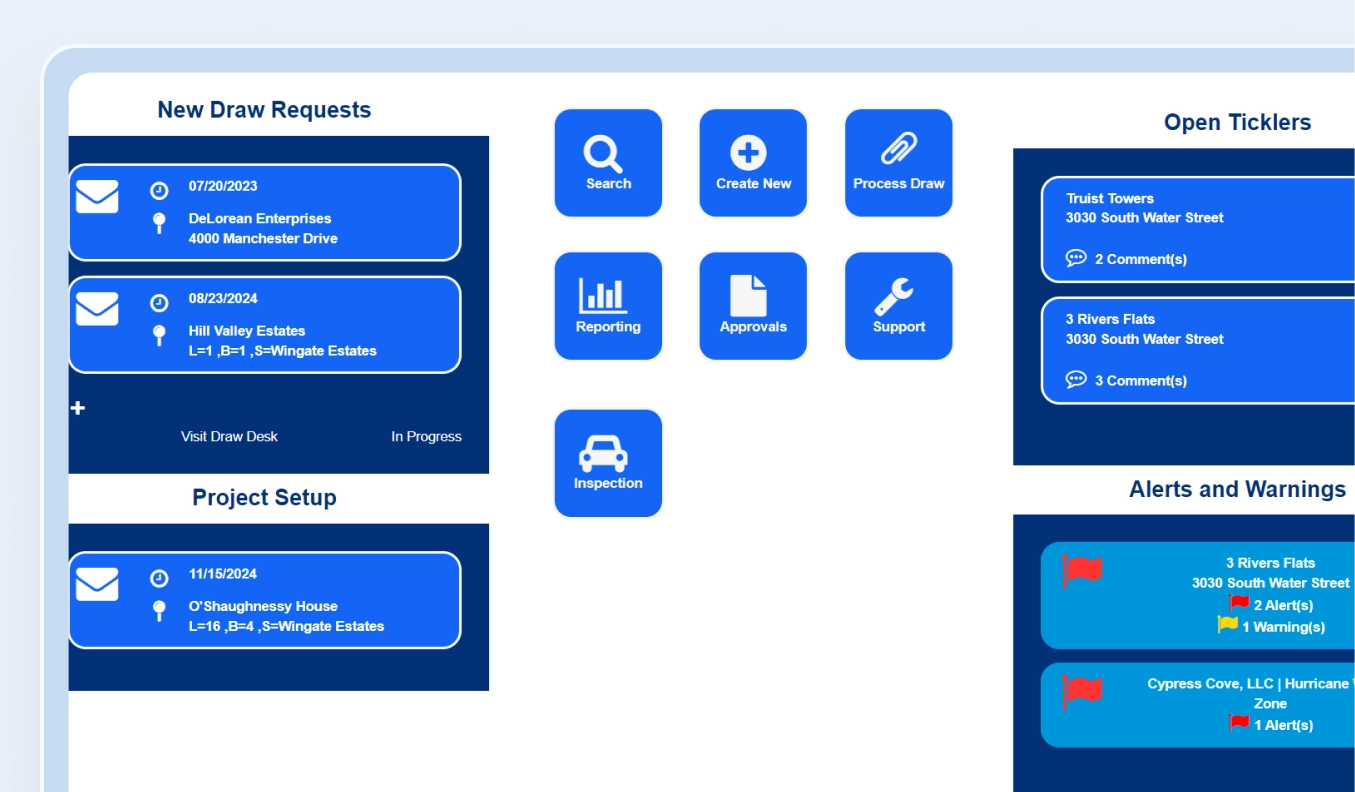

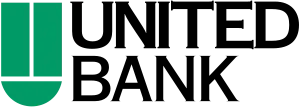

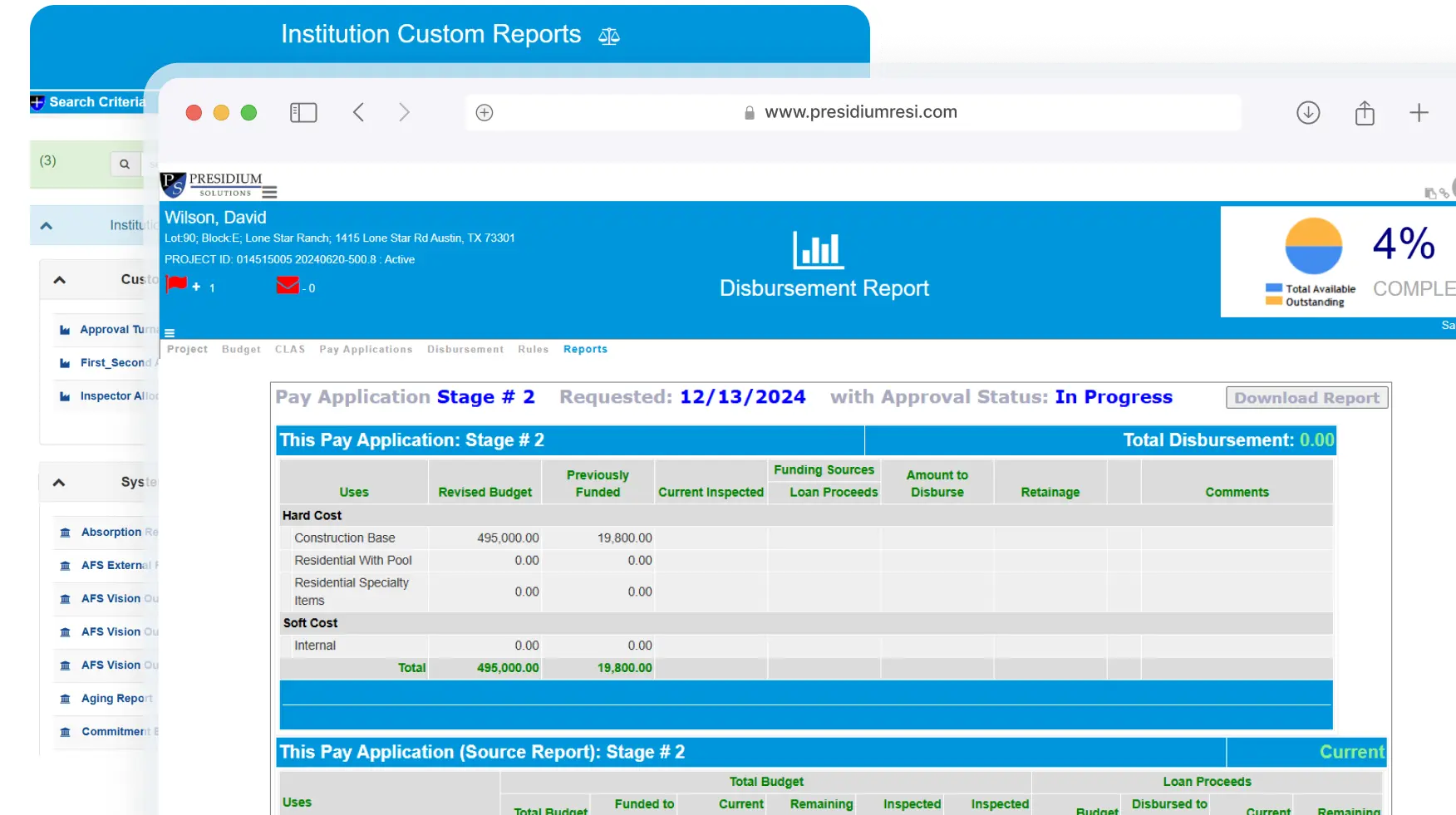

Gain complete visibility into draw requests with real-time updates and automated approval workflows to minimize delays.

Stay ahead of potential issues with instant notifications and data-driven alerts that keep projects on track and lenders informed.

Effortlessly manage vendor data and streamline communication to ensure faster processing and improved project outcomes.

Access actionable insights across your entire portfolio with custom reporting tools designed for smarter decisions.

Lender

“As a CRO, I rely on Presidium for accurate insights and risk management. The platform streamlines loan administration while ensuring compliance with our internal standards. It’s a game-changer for risk mitigation and portfolio oversight.”

– Chief Risk Officer, National Bank