Presidium Solutions

Commercial Construction Lending

Streamlined, Controlled, Profitable

Configurable workflows for A&D, CRE, Multi-Family & Mixed-Use, Builder Finance, and SBA programs. Designed to accelerate funding while mitigating risk.

Trusted by Commercial Construction's Largest Lenders

Construction Loan Management For Commercial Lending

Acquisition &

Development (A&D)

Commercial

Real Estate

Multi-Family &

Mixed Use

SBA 504/7(a)

Low Income Housing Tax Credit (LIHTC)

Why Presidium

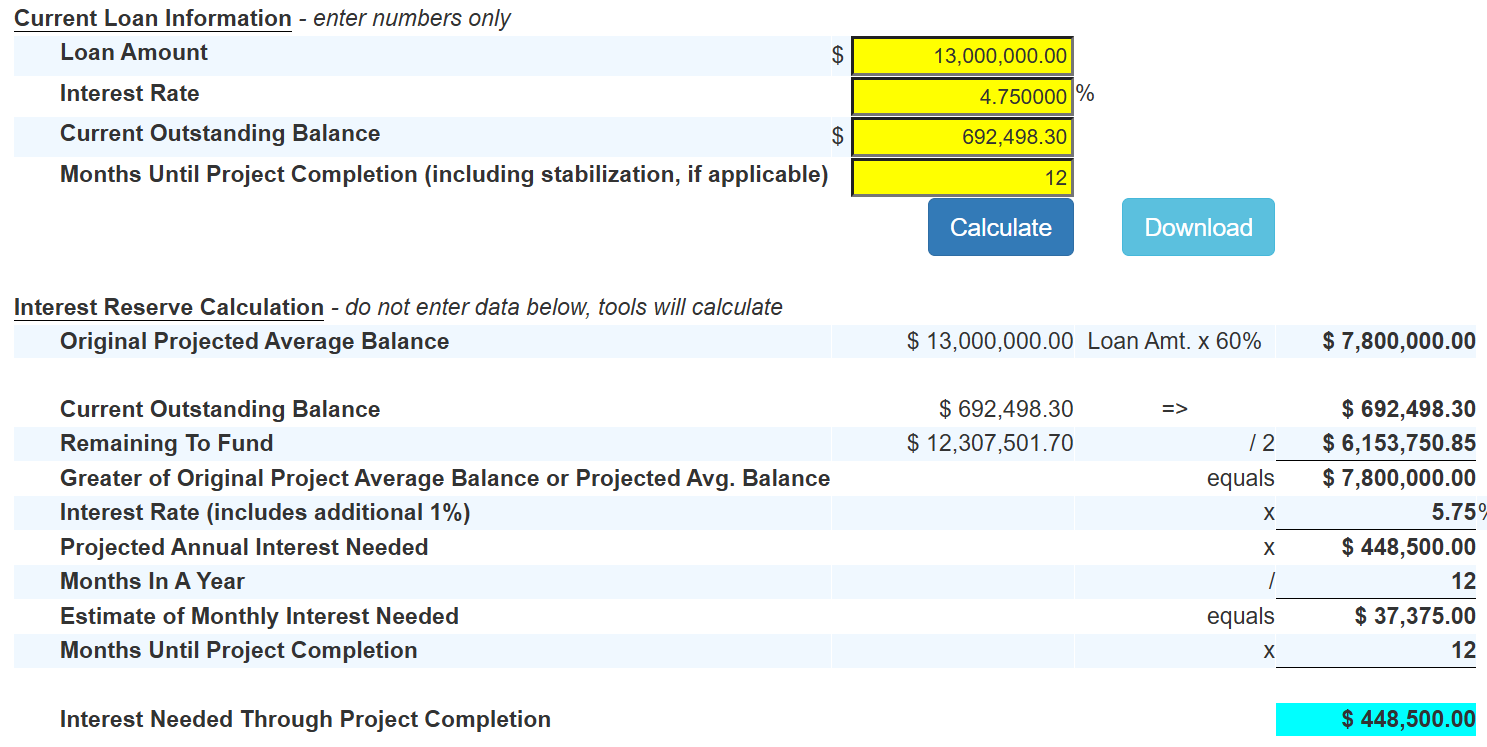

Maximize Interest Income

Faster draw cycles with customized workflows & exception based approvals.

Reduce Administrative Burden

Replace spreadsheets with automated form letters, dynamic checklists, and one-click reporting.

Strengthen Controls

Audit-ready logs, conditional approvals, and comprehensive lien waiver & compliance monitoring.

Core Features

Seamlessly manage your porfolio from nearly anywhere.

Automated

Form Letters

Generate, style, and auto-send letters at each stage of the loan.

Change Order Management

Submit, review, and approve budget revisions with full impact analysis.

Waiver & Lien Monitoring

Collect WAA, conditional, and final lien waivers from each payee, and automatically flag any gaps or mismatches.

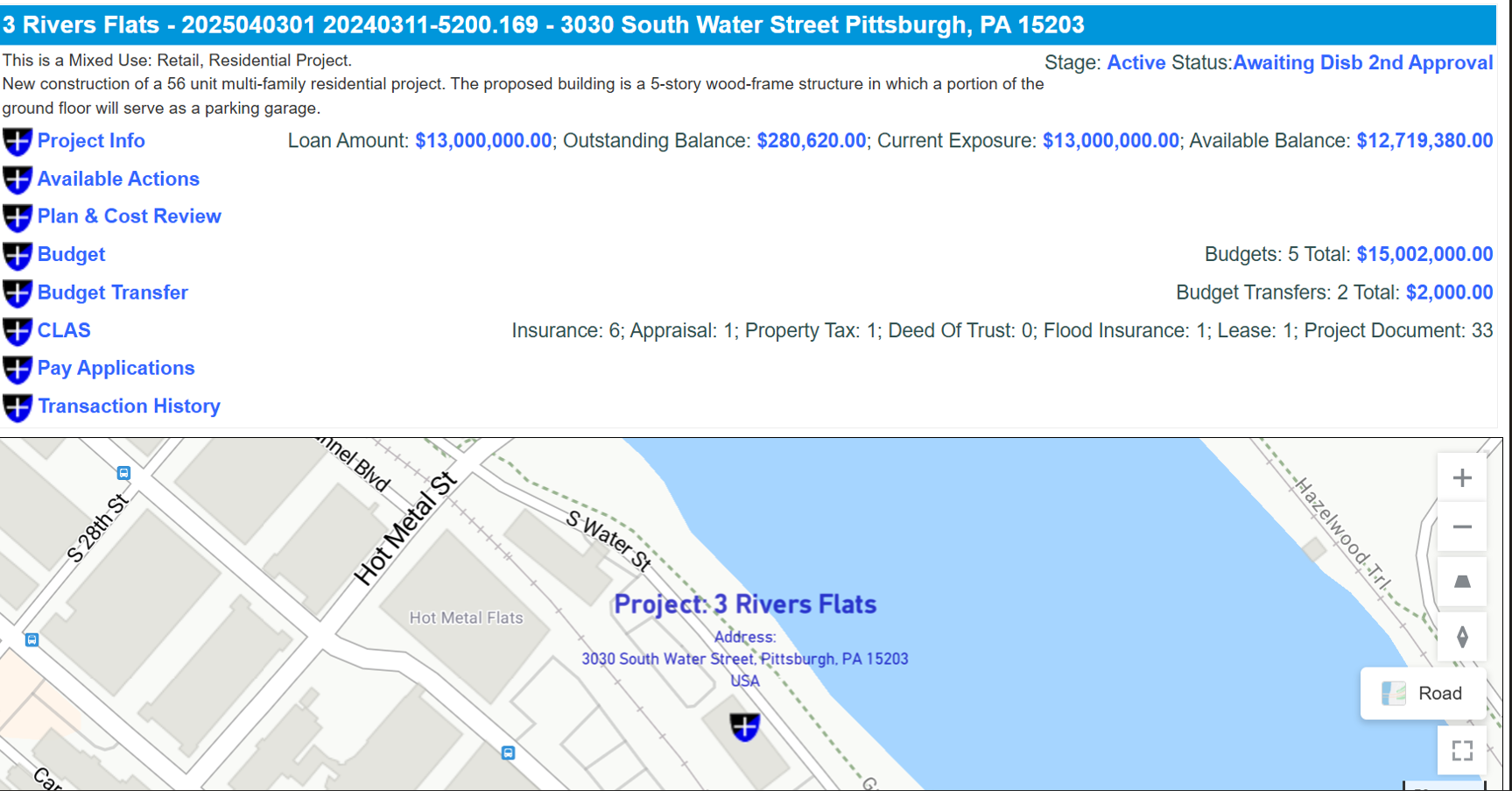

Draw & Disbursements

Allow borrowers and contractors to request draws through an online portal with role-based approval routing.

Sources & Uses Reconciliation

Prevent over-advances with automated sources-and-uses checks at each draw.

Checklist & Conditions

Use pre-defined or customizable checklists based on project type type or business segment.

Reporting & Analytics

Monitor your portfolio with live dashboards, pipeline overviews, and real-time exception queues.

Integrations

Connect seamlessly to core banking systems, loan origination software (LOS), document imaging platforms, and payment systems.

How does it work?

Presidium makes complex become simple.

Onboard

Onboard loans using product specific or customized templates and checklists to capture data and requirements.

Monitor & Request

Monitor project progress and accept draw requests via a secure white-labeled external user portal.

Approve & Disburse

Approve draws and disburse funds with confidence & reconcile issues before funding.

Report & Audit

Get complete visibility with real-time dashboards and activity logs, and generate exam-ready audit reports.

See how much faster your portfolio can move.

Trusted by Lenders Nationwide

“With Presidium, our inspection and approval cycles dropped by nearly two days. We are accelerating draws, reducing admin work, and directly boosting returns.”

– Senior Vice President

Frequently Asked Questions

Presidium uses exception-based processing, integrated inspections, and automated form letters to remove manual bottlenecks. By automating routine follow-ups and approvals, draws are processed and funded much faster, which means interest starts accruing sooner.